b&o tax rate washington state

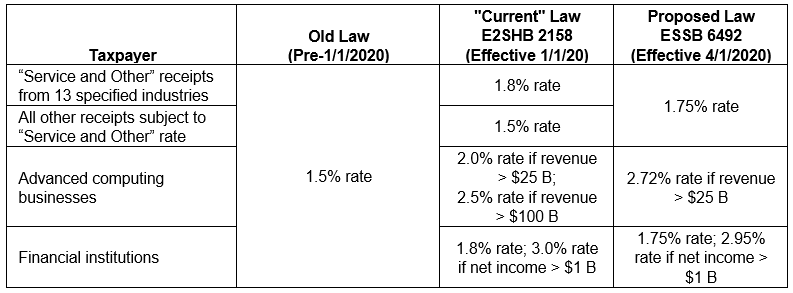

Beginning with business activities occurring on or after January 1 2020 HB 2158 will impose an increase to BO tax surcharges for the Services and Other Activities. The business and occupation BO tax is a gross receipts tax assessed on the value of products gross proceeds of sale or gross income of a business.

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification.

. Washington cities may also. Business and occupation tax. The tax amount is based on the value of the manufactured products or by-products.

B O tax rates When paying the B O tax to the Department of Revenue you declare your income in different categories. Look up a tax rate. Ad Integrates Directly w Industry-Leading ERPs.

Local business occupation BO tax rates Effective January 1 2022 City Phone Manufacturing rate Retail rate Services rate. If a taxpayer had taxable income of 1 million or more in the. Multiple Activities Tax Credit MATC Small Business BO Tax Credit.

The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax. Gambling Contests of Chance less than 50000 a year rate 15 percent. Reduce audit risk as your business gets more complex.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Most Washington businesses fall under the 15 gross receipts tax rate. V voter approved increase above statutory limit e rate higher.

Auburn adopted a BO tax effective January 1 2022. Washington State is considered one of the better tax states in no small part because of. Contact the city directly for specific information or other business licenses or taxes that may apply.

Reduce audit risk as your business gets more complex. Small Business B. State excise tax interest rates.

Have a local BO tax. AWC Tax User fee survey. The additional tax is imposed at a rate of 12 of gross income taxable.

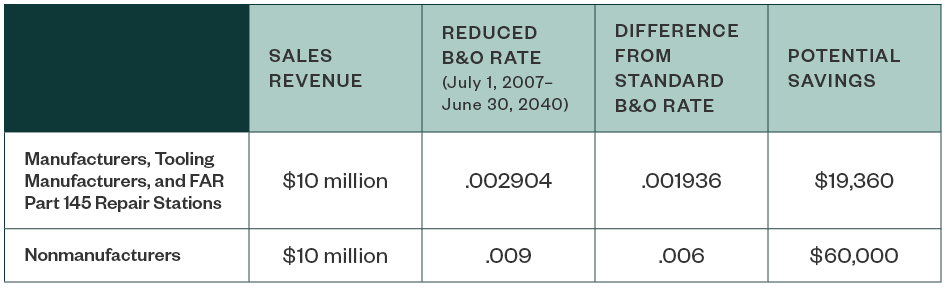

The credit varies depending on the amount of BO. Commercial Aircraft Manufacturing RCW 8204260 11 Wood. The 2019 Washington legislation includes BO tax updates and a move to a graduated real estate excise tax.

Specified business will pay BO tax at a rate of 18 on their taxable Washington. Service and Other Activities. Gambling Contests of Chance 50000 a year or greater rate 163 percent.

A business whose BO tax liability is below a certain level is entitled to a credit. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. City BO Tax Model Ordinance 2019 version.

Marketplace facilitators such as Amazon typically collect. Ad Integrates Directly w Industry-Leading ERPs. Legislation adopted in the 2003 session required the 45 cities with.

Manufacturing Catch All classification if manufacturing activity is not provided a special BO tax rate. Washington REALTORS has been made aware of direction from the Department of Revenue that is circulating among the real estate community regarding State BO Tax rates. The BO tax rate for these businesses remains at 15.

If youre unsure how your business. The major classifications and tax rates are. Additional BO tax imposed on financial institutions violates Commerce Clause.

Youll find rates for sales and use tax motor vehicle taxes and lodging. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates.

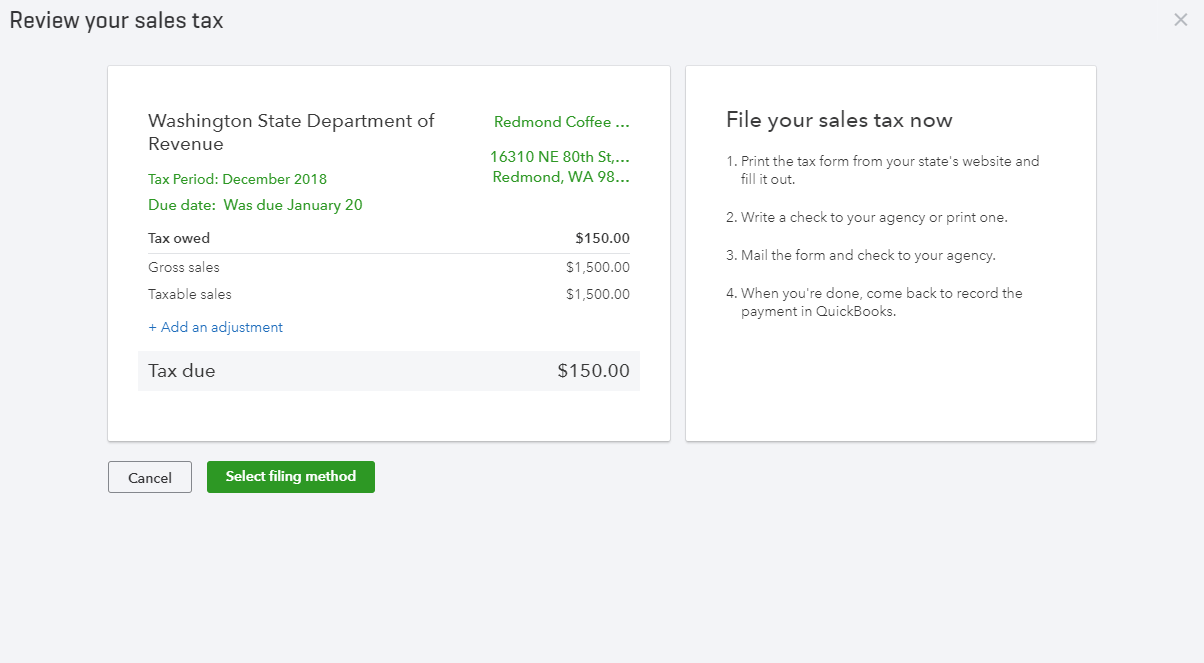

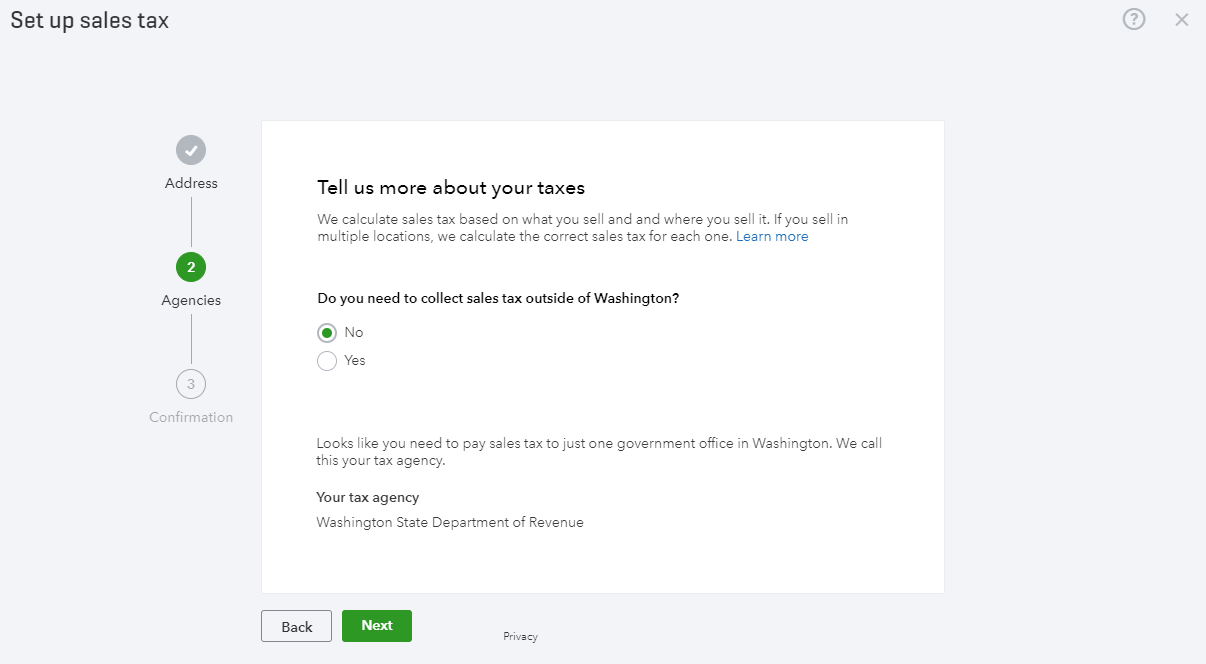

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

A Guide To Business And Occupation Tax City Of Bellingham Wa

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

B Amp O Tax Guide City Of Bellevue

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Business And Occupation B O Tax Washington State And City Of Bellingham

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Why Our B O Tax Is Unfair R Seattlewa